Scanner

- About

| Date | 10:37am | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Actual | ||||||||||

| Wed Jun 4 | ||||||||||

| Wed Jun 4 | 12:30am | USD | FOMC Member Logan Speaks | |||||||

1:30am | USD | API Weekly Statistical Bulletin | ||||||||

| USD | Wards Total Vehicle Sales | 15.7M | 16.0M | 17.3M | ||||||

6:30am | AUD | GDP q/q | 0.2% | 0.4% | 0.6% | |||||

12:15pm | EUR | Spanish Services PMI | 51.3 | 52.8 | 53.4 | |||||

12:45pm | EUR | Italian Services PMI | 53.2 | 52.1 | 52.9 | |||||

12:50pm | EUR | French Final Services PMI | 48.9 | 47.4 | 47.4 | |||||

12:55pm | EUR | German Final Services PMI | 47.1 | 47.2 | 47.2 | |||||

1:00pm | EUR | Final Services PMI | 49.7 | 48.9 | 48.9 | |||||

1:30pm | GBP | Final Services PMI | 50.9 | 50.2 | 50.2 | |||||

10:43am | USD | ADP Non-Farm Employment Change | 37K | 111K | 60K | |||||

5:30pm | CAD | Labor Productivity q/q | 0.2% | 0.2% | 1.2% | |||||

| USD | FOMC Member Bostic Speaks | |||||||||

| USD | FOMC Member Cook Speaks | |||||||||

6:45pm | CAD | BOC Rate Statement | ||||||||

| CAD | Overnight Rate | 2.75% | 2.75% | 2.75% | ||||||

| USD | Final Services PMI | 53.7 | 52.3 | 52.3 | ||||||

7:00pm | USD | ISM Services PMI | 49.9 | 52.0 | 51.6 | |||||

7:30pm | CAD | BOC Press Conference | ||||||||

| USD | Crude Oil Inventories | -4.3M | -2.9M | -2.8M | ||||||

11:00pm | USD | Beige Book | ||||||||

- Gold leads|Interactive Trading|78,458 replies fontu replied 3 min ago 3362.60 limit now important of impulse up try now ! not necessary for next bull restart ...

- USD/JPY Discussion leads|Interactive Trading|90,319 replies carbonmimeti replied 7 min ago from post 90290.....2 day cycle= 1+1 and then UP

- I will code your EAs and Indicators for no charge leads|Platform Tech|77,696 replies FxArt.Trader replied 9 min ago Maybe you are not searching for the right keyword I saw this according to your screenshot ...

- Cable Update (GBPUSD) leads|Interactive Trading|860,961 replies birdland replied 18 min ago if GU falls to the blue zone again, I will definitely buy...maybe even before.

- EURUSD only leads|Interactive Trading|209,865 replies oo7rai replied 31 min ago i choose/ apply entry signals only after the 3rd confirmation

- Experimental MT5 EA using Gemini Flash API - GeminiCommanderEA_v1 leads|Platform Tech|12 replies Bl4ckP3n9u1n replied 5 hr ago For anyone who has tried the GeminiEA and found there was a API error, I realised that I had a ...

- E/U M1, one position leads|Trading Discussion|60 replies BlackNapkins replied 17 hr ago one more with huge help of luck... buy limit on 61,8 % of EU range {image}

- Crypto Open Interest (OI) trading system by Lekkim leads|Trading Systems|364 replies MachineLearn replied 5 hr ago Just my opinion mate, no hard feelings.

- Guppy re-invented leads|Trading Systems|1,549 replies walvekarraje replied 4 hr ago If you can post trade with our templete, others may learn from your entry and exit.

- Nasdaq-Simple Intraday Strategy leads|Interactive Trading|2,148 replies Fadhl replied 14 hr ago Market has spoken: Bad news is still good news for equities! I'm done for the day with NQ. So ...

- "AUSSI" my thread and anything I want to put here leads|Interactive Trading|77,711 replies Lithuania replied 19 min ago Long sitting on my hands

- From anz.co.nz|4 hr ago

-

From media.rabobank.com|5 hr ago

From media.rabobank.com|5 hr agoLast month, after running a range of trade war scenarios in a global macroeconometric model, we concluded that the probability of a recession in the US was larger than 50% (for ...

-

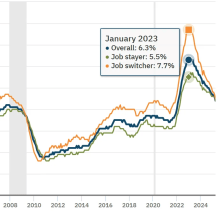

From stayathomemacro.substack.com|8 hr ago

From stayathomemacro.substack.com|8 hr agoIt�s Jobs Week. Yesterday was the release of job openings and labor turnover for April, Tomorrow is the unemployment insurance claims for the last week of May, and Friday is the ...

-

From cnbc.com|10 hr ago

From cnbc.com|10 hr agoU.S. President Donald Trump�s trade policies have rocked global equities in recent weeks, driving investors to seek out pockets of safety in financial markets. One of the ...

-

From morningstar.com|5 hr ago|1 comment

From morningstar.com|5 hr ago|1 commentU.S. stocks have largely recovered their losses from April's tariff-induced market meltdown. The dollar hasn't been so lucky. After a historic years-long run that briefly brought ...

-

From finance.yahoo.com|3 hr ago

From finance.yahoo.com|3 hr agoTreasury yields tumbled after weaker-than-expected gauges of job creation and service-sector activity strengthened traders� conviction that the Federal Reserve could cut interest ...

Sessions